Coronavirus – Ultra-High Net Worth Response to Black Swan Events

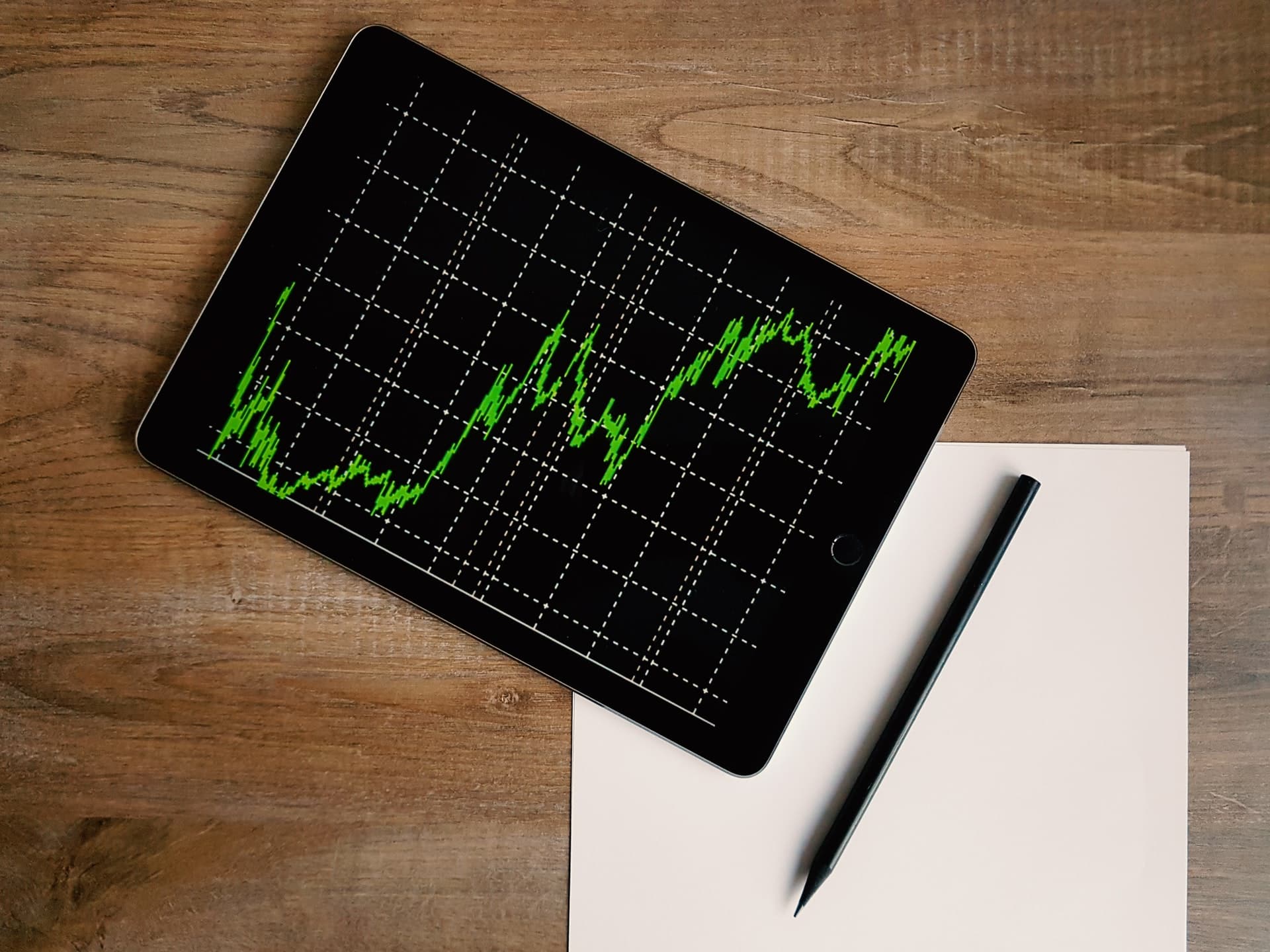

Coronavirus – Ultra-High Net Worth Response to Black Swan Events We’re In the Midst of a Black Swan Event – Here’s How to Respond Warning Sign: You Aren’t 100% happy! You’ve heard it over and over again when the market crashes in a Black Swan event: Stay the course. Wait it out. Don’t change anything … Read more