3 Tax Minimization Estate Planning Strategies For High Net Worth

As ultra-high-net-worth families age, concerns about the impact of estate taxes often increase. Many worry that a significant portion of their estate will be lost to taxes rather than being passed on to the people, causes, and places they care about. This highlights the importance of having comprehensive estate planning strategies for high-net-worth individuals.

Taking steps to minimize tax liabilities early on can help preserve wealth for future generations. For individuals with $5 million or more in liquid investable assets, it is crucial to take a proactive approach to estate planning. Building a knowledgeable team of advisors will ensure that you have the right strategies in place to protect your wealth and achieve your long-term goals.

Table of Contents

In this section, we focus on three key estate planning strategies that families can implement to reduce estate tax liabilities, ensuring more of your wealth is passed on according to your wishes.

Not all strategies are suitable for every family, so it’s important to evaluate each one carefully, discuss your options with your advisory team, and make informed decisions to secure the future of your family.

High Net Worth Estate Planning

High-net-worth individuals and families need a comprehensive estate plan to provide protection and security — protection from taxes and creditors, and security for the future of their wealth and assets.

1. Private Foundation

There are at least two key reasons to consider starting a private foundation as part of your estate planning strategy:

1. Making a Positive Impact on Causes You Care About

A private foundation is a tangible way to channel your wealth into causes you care about. Whether supporting world hunger, medical research, higher education, or cultural institutions like museums, a foundation allows you to make a lasting impact far beyond your lifetime. This can be a critical priority in your estate planning strategy for high-net-worth individuals.

2. Preventing Wealth from Having a Negative Influence on Family Members

Charitable giving can be an effective way to prevent wealth from negatively influencing younger family members. If you have heirs or other family members who you believe may not responsibly manage your wealth after your passing, a private foundation can help limit their access to it, ensuring the wealth is used as intended.

What Is a Private Foundation?

A private foundation is a nonprofit entity that can be funded with cash or appreciated assets. Establishing a foundation provides a tax deduction and helps reduce the size of your estate, thereby lowering your estate taxes. The tax benefits can vary depending on how the foundation is funded.

It’s important to have open discussions with your heirs about how much of your wealth will be allocated to the foundation. The foundation will be more effective if your family is united in its mission and goals.

For example, if you have $200 million in assets, you could fund a foundation with $100 million while still leaving the same amount to distribute to your heirs. This strategy could reduce your estate tax by approximately $40 million, assuming current tax rates remain unchanged.

Other Wealth Protection Strategies

Another related wealth protection strategy is making large donations to a nonprofit organization. While this requires giving away part of your estate, it allows you to direct those funds to causes you care about. If you choose not to make these charitable donations, the government will take 40% of your estate at current tax rates. By making the donation, you have control over where the money goes.

When combined with a private foundation and well-chosen trusts, these strategies can significantly reduce your estate tax burden, preserving more of your wealth for future generations.

When considering strategies to minimize estate taxes and protect your wealth, private foundations and charitable donations can be highly effective. Working with an experienced financial advisor and exploring other estate planning strategies can help you achieve your financial goals and secure your legacy.

2. Life Insurance

Life insurance plays a crucial role in estate planning strategies for high-net-worth families. It serves two primary purposes most frequently:

- Paying Estate Taxes

Life insurance can be used to cover estate taxes, preserving the value of the estate itself. This is particularly important in situations where a significant portion of the estate is tied up in illiquid assets, such as a family-owned business or real estate.

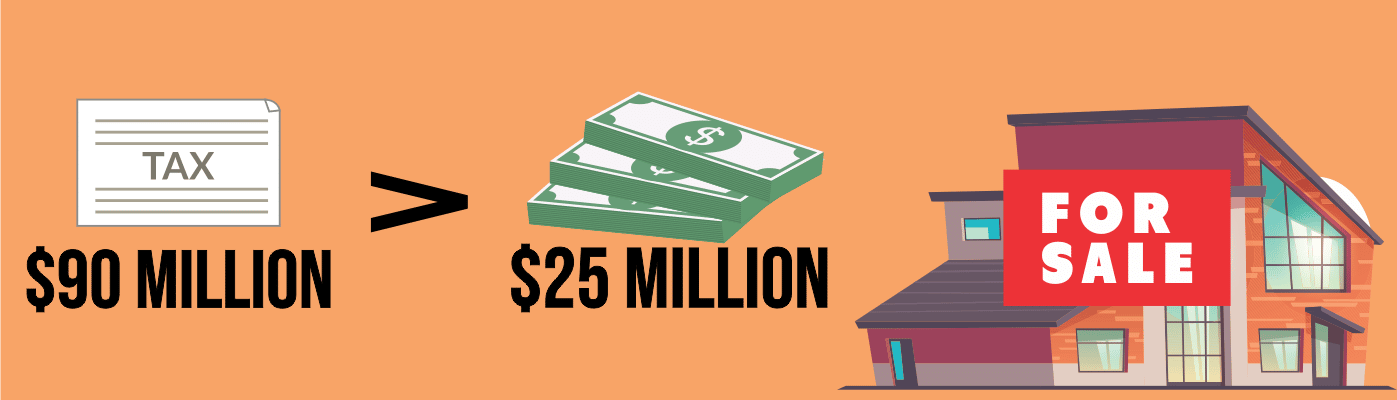

For example, suppose your estate consists of a $150 million business, $50 million in real estate, and $25 million in liquid assets. At the current 40% estate tax rate, your estate would owe approximately $90 million in taxes, far more than your liquid assets can cover. This could force your heirs to sell parts of the estate, such as the business or real estate, to pay the taxes.

By securing a life insurance policy, you can ensure that the proceeds cover most, if not all, of the estate taxes, helping keep valuable assets within the family. This strategy, when combined with other estate planning techniques, is an effective way to protect your wealth. - Equitable Distribution Among Heirs

Life insurance can also be used to provide an equitable distribution of your estate among your heirs, especially if some family members are inheriting illiquid assets, such as a business or real estate, and others are not.

For instance, if you have two children and only one is capable or interested in taking over the family business, the business may be passed on to that child. However, this creates an imbalance in the division of your estate. The other child, inheriting the real estate and liquid assets, may receive a smaller portion.

In this scenario, a life insurance policy can be structured to provide the non-business heir with additional compensation, creating a more balanced inheritance. This helps maintain family harmony while ensuring fairness in the distribution of wealth.

Additionally, life insurance premiums can be structured to be removed from your estate without counting against your net worth or annual gift exclusion. This can be achieved through an irrevocable life insurance trust (ILIT), which provides further flexibility in estate planning.

Life insurance is a valuable tool for high-net-worth estate planning, especially when it comes to managing estate taxes and ensuring fair distribution among heirs. When combined with other estate planning strategies, it can help protect your wealth and preserve your legacy.

3. Family Limited Partnership

A family limited partnership (FLP) can be an effective strategy as part of your estate planning for high-net-worth families. It can help reduce the value of your estate, protect assets from potential losses, and provide benefits, especially if family dynamics evolve over time. However, like many estate planning and tax minimization strategies, FLPs are complex to set up, and it’s crucial to work with a specialist who has experience in these areas.

Working with the right team of professionals, including estate attorneys, tax attorneys, and CPAs, is essential. You must be as selective with these specialists as you are when choosing a financial advisor. Their expertise is crucial for implementing the most effective estate planning strategies for high-net-worth individuals.

How Does a Family Limited Partnership Work?

In a family limited partnership, there are two main types of partners:

- General Partners: These partners have full control over the management and investment decisions of the partnership’s assets. They also bear all the liability. Typically, in a family limited partnership, the general partners are the patriarch and matriarch of the family.

- Limited Partners: Limited partners do not participate in managing the partnership’s funds, and they have limited liability.

The general partners contribute assets to the partnership and then transfer ownership interests, either directly or through a trust, to their children or grandchildren. This transfer can occur upon the death of the general partners or during their lifetime.

For All Tax Minimization Strategies

It is essential to ensure that your family is in agreement about the estate planning strategies you choose and understands why these strategies are important. Whether it involves forming a private foundation, using life insurance, establishing a family limited partnership, creating a trust, or combining multiple approaches, your family must be aligned around the plan and fully aware of their roles.

If family discord or differing opinions arise, it may be beneficial to consult with specialists in these areas to facilitate the process. Although it’s still possible to move forward without unanimous agreement, navigating such a plan may become more challenging. Therefore, fostering positive family relationships should be an integral aspect of your estate planning strategies for high-net-worth families.

Ideally, you will want to engage in thorough and detailed discussions with both your family and your team of advisors about the future of your estate. Open conversations will ensure that everyone understands the plan and is on the same page.

For instance, if you are considering starting a private foundation, it is important for your family to be excited about the idea and its potential impact. This might involve discussing your values, passions, and interests as well as those of other key family members to ensure alignment.

5 Essential Aspects of Estate Planning for High-Net-Worth Families

- Protection, Protection, Protection

- Securing the Family Legacy through Trusts

- Medical and Disability Directives

- Avoiding Costly and Lengthy Probate

- Estate and Income Tax Minimization or Elimination through Gifting

By now, the importance of estate planning strategies for high-net-worth individuals should be clear. The question now is: How do I implement the right strategies to minimize estate taxes and secure my legacy?

Taking action on these essential aspects of estate planning is crucial for protecting your wealth and ensuring its smooth transition. It is vital to work with experienced professionals who can guide you through these processes and help create a plan that aligns with your goals.

5 Estate Planning Strategies to Start Protecting Your Wealth and Your Family

To ensure the smooth transition of your assets to your beneficiaries, a well-crafted estate plan is essential. An estate plan includes a will, but it also outlines how your estate will be managed in case of incapacity. Here are five strategies to get you started:

1. Decide Who Will Carry Out Your Estate Plan

Your estate plan details your wishes for distributing assets after your death, including who will carry out your plan. In addition to an executor, you may want to appoint a durable power of attorney to make decisions on your behalf if you become incapacitated.

If you have minor children, it’s essential to designate a guardian to take care of them. You may also want to assign someone to act as a health care power of attorney to make medical decisions for you in the event that you’re unable to make them yourself.

2. Keep Your Retirement Accounts Up-to-Date

While your will outlines the distribution of your estate, the beneficiaries named on your retirement accounts determine how those funds are allocated. Regularly reviewing and updating these beneficiaries, especially after significant life events (e.g., marriage, divorce), helps ensure your estate plan remains aligned with your wishes.

3. Get Educated About Estate Taxes

Only individuals with estates valued over a certain threshold are subject to federal estate taxes. Currently, if your estate is valued at less than $12.06 million, you will not owe federal estate taxes. However, this exemption limit will revert to $5.49 million in 2025. Some states and the District of Columbia impose their own estate taxes, and certain states also have inheritance taxes, where beneficiaries pay taxes on the income they receive from the estate. Be sure to understand how estate taxes apply to your situation.

4. Remember the Gift Tax Exemption

By gifting up to $16,000 per person annually (without tax implications), you reduce the taxable portion of your estate. However, note that the lifetime estate exemption is reduced by the value of your gifts, so it’s important to factor this into your planning.

5. Establish a Trust

A trust directs the distribution of your assets after death and may include provisions for managing assets until beneficiaries reach a specific age or milestone. Unlike a will, a trust can be created during your lifetime (a “living trust”) or as part of your will (a “testamentary trust”).

Trusts can be revocable, meaning they can be altered or terminated, or irrevocable, where control of assets is relinquished to a trustee. An irrevocable trust removes those assets from your estate, potentially reducing estate taxes. Some trusts, such as charitable trusts, may also offer tax benefits or provide income for the grantor while benefiting charitable organizations.

Estate planning can be complex, but having the right strategies in place is crucial to preserving and protecting your wealth for future generations.

Take the Next Step: