Retirement Withdrawal Strategies That Keep My Finances Strong

I’ve spent a lot of time exploring retirement withdrawal strategies to keep my finances on solid ground, and I’m excited to share what I’ve learned. With so many ways to tap into my nest egg, I’ve found it helps to compare each approach side by side and figure out which one feels right for my goals. Let’s look at six popular methods that I’ve tried, read about, or seen in action.

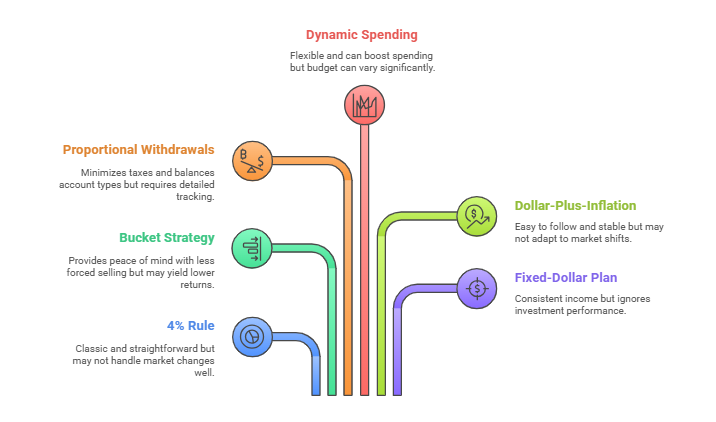

Use the 4% Rule

This classic rule suggests I withdraw 4% of my retirement savings in the first year, then adjust yearly for inflation. It’s based on research that often assumes a 30-year time frame and a balanced portfolio. While it’s straightforward, it can feel a bit rigid if I have a much longer retirement or experience unsteady market returns. Studies by U.S. Bank (U.S. Bank) and Vanguard (Vanguard) suggest this rule works best for a stable 30-year horizon, but it may need tweaks for early or extended retirements.

Try the Bucket Strategy

With the bucket strategy, I sort my retirement money into three timeframes: short-term (cash or low-risk bonds), medium-term (a balanced mix), and long-term (more stocks for growth). This way, I can handle day-to-day expenses from my short-term bucket while leaving my equity-heavy bucket to (hopefully) grow over time. The downside is that I might not maximize growth if I keep too much in low-yield buckets. Still, it’s comforting to know I won’t be forced to sell my riskier assets in a downturn.

Pick Proportional Withdrawals

You’ve probably seen me mention taxes a hundred times, but that’s because they matter. Proportional withdrawals mean I draw money from taxable accounts, tax-deferred accounts, and Roth accounts in set proportions. Fidelity (Fidelity) highlights that taking from different “tax buckets” can reduce my overall tax liability. It’s more complex than a simple rule of thumb, but if I want to optimize my after-tax income, this approach can be powerful.

Embrace Dynamic Spending

Dynamic spending strategies let me adjust withdrawals from year to year based on how my portfolio’s doing. If markets soar, I might safely spend a little more. If the market slumps, I tighten my belt so I don’t run out of money too soon. Vanguard’s research (Vanguard) shows this approach can boost spending levels over time while helping preserve my resources. The catch? My annual budget can fluctuate, so I have to be ready for some swings.

Consider Dollar-Plus-Inflation

This method has me pick a percentage for Year One (like 4% or 5%), then bump the dollar amount each year by inflation. It’s easy to follow, but it doesn’t flex much if the stock market behaves unpredictably. According to Vanguard, the dollar-plus-inflation strategy is simple but can be less efficient when big market shifts happen.

Test a Fixed-Dollar Plan

Sometimes, I just want to pull out the same dollar figure each year. This plan offers predictability: I know exactly how much I get every month. But if my investments drop in value, I’m still withdrawing the same amount, which could speed up my balance decline. On the flip side, when markets surge, I don’t automatically give myself a raise.

Here’s a quick table summarizing each strategy:

| Strategy | How It Works | When It Shines | Potential Drawback |

| 4% Rule | Start with 4% first year, then inflate annually | Classic, straightforward | Might not handle big market changes |

| Bucket Strategy | Split assets into short-, medium-, and long-term pots | Peace of mind, less forced selling | Possibly lower total returns |

| Proportional Withdrawals | Pull from tax-deferred, taxable, and Roth accounts | Minimizes taxes, balances account types | Requires detailed tracking |

| Dynamic Spending | Adjust each year based on portfolio performance | Flexible, can boost total spending | Budget can vary a lot |

| Dollar-Plus-Inflation | Withdraw a set %, then match annual inflation | Easy to follow, stable raises | May not adapt well to market shifts |

| Fixed-Dollar Plan | Withdraw the same amount every year | Consistent income level | Ignores investment performance |

If I want to explore more about creating well-rounded income, I also check out the best way to get income in retirement. Plus, if I’m scratching my head over tax implications, I look at do i have to pay taxes on retirement income.

I often hear questions about choosing a safe withdrawal rate, balancing near-term needs with future growth, factoring in taxes, sorting out inflation adjustments, and deciding which accounts to tap first. All these details play a big role in selecting the right retirement withdrawal strategies for my lifestyle, especially when I want to protect my wealth for the long haul. If I want more tailored guidance, I might reach out to a retirement plan advisor who knows how to personalize each approach.

When I wrap it all up, I remind myself that there’s no one-size-fits-all solution. The trick is picking a strategy (or combining a few) that feels comfortable, flexible, and tax-smart for my retirement income planning. The good news is that I have multiple withdrawal options to choose from, and adjusting them over time can help me stay on track. If you have a tip that’s worked well for you, feel free to share. It’s always great to compare notes and keep our finances strong together.

Showcase your recognition by adding our award badge to your website! Simply copy the code below and embed it on your site to highlight your achievement.

Recent Posts

Retirement Planners in Los Angeles to Consider

Los Angeles, a city synonymous with opportunity and innovation, is...

Retirement Planners in New York to Consider

Navigating the financial landscape of New York can be overwhelming,...